Dear Editor,

The tail is wagging the dog in Guyana’s finances. The spend money for economic infrastructure and the Government outlays for social sector development- health, education, Household real income adustments to cope and experience a high standard of living should have come from the conversion of natural resources, oil, gold, bauxite, forestry, fishing into special FUNDS- Government budget surplus for non-oil sector internal development. This is not going to happen under the 2016 signed Petroleum Agreement.

Profit taxes, including windfall gains should be paid into Guyana’s Treasury as Revenues.

Currently, the design of the National Resource Fund is for Guyana to spend out its savings fast at the beginning and tapering off in the future. This needs to change along with Guyana’s Tax Sovereignty laws, so that Guyana’s material, health, and educational requirements are fully met. The savings should be leveraged to use a mix of borrowed capital plus Guyana’s earnest savings money – OPM, other people’s money. There is yet another looming problem.

Each dollar spent on infrastructure has a long tail of maintenence expenses requirement. Will Guyanese taxes be raised to cover these or will they come from special Funds? Is the Guyana’s tax base rising as fast as its economic growth rate?

The solutions to these sorts of issues may be found by looking at the Canadian Regional Input-Output planning model that Guyana had abandoned in the post-Hoyt era. There are direct and indirect material, labor, and managerial resource requirements to for each dollar spent, using input-output modeling methodology.

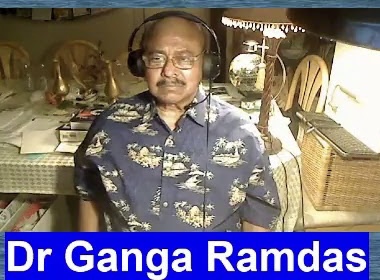

Yours truly,

Ganga Persad Ramdas, PhD, MA, MS