Guyana’s economy is expanding rapidly, but people’s expectations for quick benefits are outpacing actual gains. Many Guyanese question the lack of immediate returns from new investments and oil revenues, often drawing comparisons with developed nations which have taken decades to reach this point in their development.

Rapid economic growth is driving the PPPC government to update laws/regulations, including revising the Evidence and Companies Acts and introducing trust laws. While the process of constitutional reform has been slow, it is expected to take off in 2026. Financial regulations (like AML/CFT and Foreign Exchange transactions) are being strengthened, according to Finance Minister Dr Ashni Singh, while President Ali urges the Bank of Guyana (BoG) to “adopt data-driven policies for liquidity, inflation, and financial inclusion.”

On the question of financial inclusion, about 30% of Guyanese adults remain outside the banking system due mainly to lack of collateral. The proposed Guyana Development Bank (GDB) can bring them into the banking system by offering interest-free, collateral-free loans. Focus is given to small and medium-sized enterprises (SMEs) that operate in agriculture, tourism, hospitality, tourism and other specified sectors. The GDB will also serve as a significant poverty reduction tool, with the potential to lift a substantial number of households out of poverty.

President Ali urges commercial banks to boost lending to small and medium-sized enterprises by offering incentives like those in housing finance, lowering interest rates below 4%, and relaxing collateral requirements. He sees this as a step toward enabling successful SMEs at the Guyana Development Bank to eventually transition into the broader banking sector for expanded operations.

The National Financial Literacy will support the SME Development Bank program, which aims to help citizens make better financial decisions. So far, 10,893 SMEs have completed training in aspects of financial literacy, and a consultant is creating a financial literacy course outline. Vice-President Dr. Jagdeo says the program will reach groups such as Amerindian communities, rice farmers, law enforcement, healthcare workers, and other public and private sector professionals.

The Guyana Development Bank is expected to be launched by April 2026 with an initial capital outlay of $(US) 200 million. The source of funding may be NRF revenues which are projected to be $(IS) 2.9 billion+ .in 2026. President Ali says that focus will be on sectors like agriculture, agro-processing, tourism, creative industries, value creation, and innovation projects. Each borrower can get a loan of $(G) 3 million (maximum).

The previous failures of state-owned banks like Guyana National Cooperative Bank (GNCB) and Guyana Agriculture Development Bank (GADBANK), due to political interference and poor management under the PNC, highlight the need for stricter loan requirements and penalties for non-compliance as necessary components in future policy-making.

Government loans and grants are often treated as gifts, leading to underperformance (IDB: 2018). To address this, President Ali plans for a technical team to guide beneficiaries and monitor their progress. Ultimately, public attitudes toward using these funds should shift to prioritize transparency and accountability.

And the success of the Guyana Development Bank (GDB) will depend upon the performance of SMEs, the GDB’s relationship with the Bank of Guyana; quality leadership; the ability of SMEs to transition to commercial banks; and the prompt implementation of the National Financial Literacy Program.

Sincerely

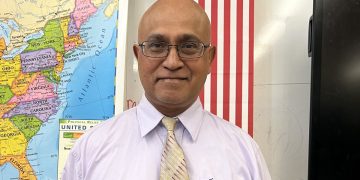

Dr Tara Singh