Dr. Ramesh Gampat

14 November 2024

Suppose I tell you, dear reader, that Guyana is rich but Guyanese are relatively poor. What would be your reaction? I’ll get to my arguments shortly but it is first necessary to gaze at the economic landscape. Prior to 2020, Guyana was largely an unknown, backwater country and foreigners often confused with Ghana, which is located in Africa. Guyana’s economic growth was lackadaisical at best, averaging 2.1 percent over the sixty years from 1960 to 2019. That changed in 2020, when Guyana became the world’s newest petro-state. While the amount of oil discovered is unknown, the figure generally accepted is in excess of 11 billion barrels. The export of crude oil delivered a much-needed boost to growth, averaging 38.8 percent from 2020 to 2024. Growth reached as high as 63.4 percent in 2022, an incredible performance that is probably unparalleled in the Americas. Not only is Guyana the world’s fastest growing economy today, but it is also much more widely known and several airlines now fly into and out of CBJ. Quite a few pieces on the country have appeared in Bloomberg and other western media, while the inflow of FDI has surged, rising from US$573.1 million in the first quarter of 2020 to US$4,595.7 million in the second quarter of 2024, which is more than twice as large as non-oil GDP.

From around 2014, a dual economy began to emerge: an oil economy and a non-oil economy. The former is a highly capital-intensive, technologically advanced, skill-intensive, high-productivity economy. It is essentially a foreign-owned export enclave devoted to a single commodity thus far, crude oil. Oil GDP was G$9.9 billion in 2019 or more than twice the previous year. Oil GDP reached G$180.20 billion in 2020, amounting to 15.8 percent of the total economy (oil + non-oil). The oil economy grew rapidly and it was more than half of the overall economy two years later and is expected to reach about 60 percent in 2024. The rapid growth of the oil economy, 67.4 percent in real terms, annually, from 2021 to 2024, buoyed up growth of the non-oil economy, which averaged 10.1 percent during these same four years. The upshot is that the total economy expanded by 37.6 percent annually. Incredibly, real GDP in 2023 was 2.6 times as large as 2020 (real GDP data for 2024 is not yet available).

Oil exports rose from US$1.1 billion in 2020 to US$11.6 billion in 2023 (it was US$9.4 billion at the end of the first half of 2024). As a share of total exports, oil increased from 19.5 percent to 69.7 percent during the same period. Oil exports comprised 56.9 percent of cumulative GDP during these four year. Given the country’s huge oil reserves, the surge in economic growth caused by the export of oil and the current spending spree about a third of which is funded by drawdowns from the Natural Resources Fund, mainly on much-needed infrastructure, and a population of less than 800,000, there is only one conclusion: Guyana is a very rich country.

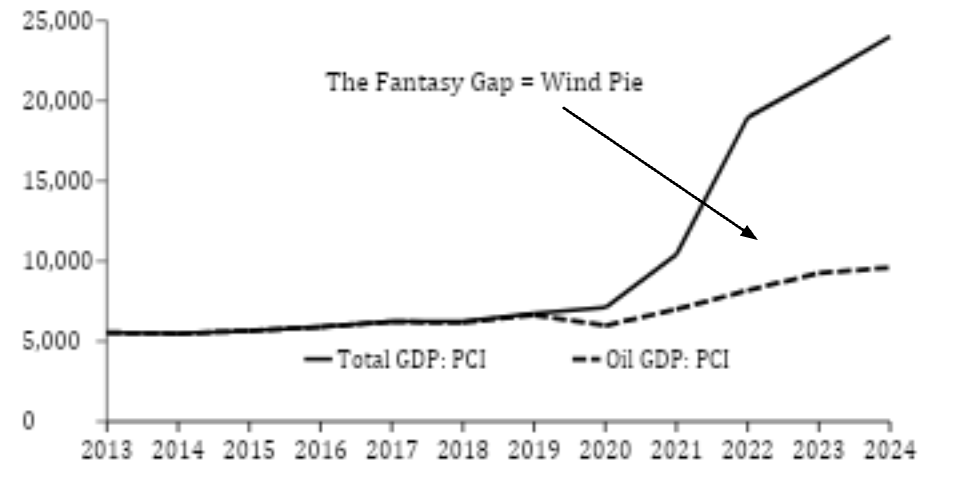

If the country is rich by the criteria presented in the above paragraphs, it is also rich by another widely used indicator: per capita income. Per capita income is normally calculated as GDP divided by population (in Guyana’s case GDP = Oil GDP + Non-oil GDP) and expressed in USD to facilitate international comparison. Income per person rose from US$5,600 in 2013 to US$7,100 in 2020 (rounded to the nearest 100), which is an increase of 28.1 percent. Three years later per capita income reached US$21,400 and is expected to climb to US$24,000 in 2024. The phenomenal “wealth” performance means that income per person in 2024 is 3.4 times as large as in 2020. In the Americas, excluding the US and Canada, only Puerto Rico, The Bahamas, Barbados, and St. Kitts and Nevis were richer than Guyana in terms of per capita income in 2023. By my calculations, only the US, Canada, The Bahamas and Puerto Rico are richer than Guyana in 2024. Income per person, too, portrays Guyana as one of the richest countries in the Americas, but the truth is revealed once the data supporting that perception is put under the microscope.

The problem with the above analysis is that the bulk of oil GDP does not belong to Guyana and should not, therefore, be used to calculate income per person. GDP = private consumption + private investment + government investment + government spending + Net exports (exports – imports). There is comparatively little government spending or investment in the oil economy so that its GDP is largely made up of private consumption, private investment and net exports. The extent to which each of these three components contribute to oil GDP is unknown because the requisite data are not available. However, given the size of oil exports, which was 1.2 times as large as oil GDP from 2020 to 2023, it is clear that most of the revenue from oil export is captured by oil companies. Spending on consumption and investment are mostly done by the foreign oil companies. In effect, the oil economy is a foreign-owned economy and, therefore, most of its GDP is foreign-owned and thus does not benefit Guyanese as much as it should. Looks, that is, can be deceiving: our total GDP is huge but only about 54 percent belongs to us.

Let’s redo the arithmetic so that income per person is based on non-oil GDP rather than total GDP. The computation shows that per capita income rose from US$5,600 in 2013 to US$9,300 in 2023, which is an increase of 66.8 percent. Of the 33 countries in the Americas for which data are available, there were 17 countries with per capita income larger than Guyana’s in 2023. In other words, Guyanese remain some of the poorest people in the Americas. Income per person in Barbados, St. Kitts and Nevis was 2.4 times as large as Guyana’s, while Trinidad’s was twice as large. Per capita income in Brazil and Grenada was larger than Guyana’s, while that of Jamaica and Suriname was around two-third of Guyana’s. The enormous difference between income per person based on total and non-oil GDP exposes what I call the “Fantasy Gap” or the perception of wealth, which began from around 2019 and grows larger yearly. The Fantasy Gap, the split in economic fortune, is readily evident from the accompanying chart.

| Income Per Person: Total GDP and Non-oil GDP |

|

| Note: Fantasy Gap = Per capita income based on Total GDP minus per capita income based on Non-oil GDP. In effect, the Fantasy Gap exists because of the oil economy (Oil GDP), which is foreign owned, does not belong to Guyanese, and hardly benefits Guyanese

Source of data: 2013-2023: BoG 2024. Annual Report 2023; BoG 2024. Half Year Report 2024. GDP for 2024 estimated by author; BoS website for population data |

Concluding, Guyana is a rich country but Guyanese are either some of the richest or some of the poorest people in the Americas depending upon how income per person is measured. The idea that Guyanese are rich is an erroneous arithmetical idea; there is no substance to it. The error stems from dividing total GDP (oil + non-oil = total income) by the population, which produces a very high income per person. Since oil-GDP, at least most of it, is neither owned nor enjoyed by Guyanese, it should be excluded from the calculation so that appropriate numerator in the division is non-oil GDP. By the “oil” metric, Guyanese are rich, but by the “non-oil” metric Guyanese are poor.

To give you an idea of the magnitude involved, non-oil income per person was only about 42 percent of total income (oil + non-oil) during the last three years, including this one. The inclusion of oil GDP in the per capita income metric creates the perception that Guyanese are rich, about 58 percent richer than they actually are. Many years ago, an Australian forestry professional working in Guyana told me that you cannot eat what you do not have. That’s still the case as far as I know – we are producing plenty of oil but only the crumbs gets routed to our tables. Hence, the oil economy does not benefit the average Guyanese much even though it enriches the well-connected.