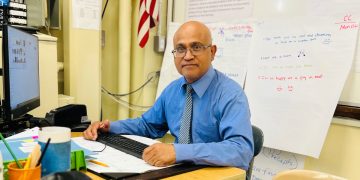

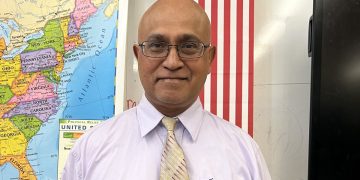

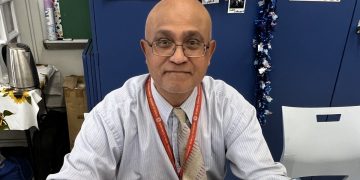

Should Guyana adopt the American dollar or revalue its currency which is currently trading at $206 (and purchasing at $212) to one American dollar? Prof Tarron Khemraj penned a series of columns in Guyana on “dollarization of Guyana’s economy”. Anyone who studied economics as Dr Khemraj, Dr. Ramesh Gampat, myself (Dr Vishnu Bisram) and others did, the US dollar is the accepted monetary unit for international trade. It is also the benchmark for the financial stability of a country. The currency is under the guidance of the US Central Bank called the Federal Reserve. Interest rates globally take a cue from what happens at the Federal Reserve which controls the flow of dollars. The US Greenback will remain the dominant unit for international trade in the foreseeable future.

However, it is noted that proposals are floating around of adopting the Chinese Yuan or creating some other currency (as mentioned at BRICS meetings) for trade. Some countries have returned to trade with each other using their local currencies – Yuan, Ruble, Rupee, etc. Because of conflict or tension between China and several countries including India and Western powers, the Yuan will not be favored as a currency of international trade. And there is not likely to be another global currency for trade other than the dollar; the BRICS meeting in South Africa in August will not create a new global currency. Thus, Guyanese policymakers should take a look at adopting the Greenback (US dollar) as a currency to conduct local business if not as the country’s currency. The US has an open-door policy on other countries using the dollar as their currency. There are several benefits to adopting the greenback as it will greatly expand trade and connection with the US. Guyana will also become a more vibrant market for American goods and services, strengthening ties and protecting the country from threatening neighbors. It will eliminate exchange rate fluctuation that bedevils borrowers and exporters. It will also tame inflation and lead to lower interest rates to borrow money. It is a way to bring stability to an economy that faces inordinate issues.

The dollar has remained the currency for international financial transactions since the collapse of the Bretton Woods system and the end of using gold to prop up a currency. And even if there is another currency, Guyana would be better off being protected from the vagaries of global trade by locking itself into a currency that is stable. The US dollar has been the most stable currency throughout history. The Fed takes appropriate policy to control inflation and to maintain exchange rate stability with global currencies (especially Euro, Yen, and Pound).

It has gained value against all major currencies including Euro, Pound, Canadian dollar, Yuan, Yen, Rupee, and others. Every country and every individual craves the dollar because of its importance for foreign travel and for international trade.

On adopting the US dollar by other countries, then Federal Reserve Chair Alan Greenspan in 1999 said the US position was “it is open to proposals” from other countries. That policy has remained unchanged, and as Khemraj pointed out, several countries have adopted the dollar as their monetary unit. Several countries are toying with the idea of adopting the US dollar as their national currency. Mexico and Argentina toyed with the idea of adopting the dollar in order to control inflation and the sliding value of their currencies. Mexico, Argentina, Brazil, and other countries were known to change or revalue their currencies against the dollar in order to control inflation. Countries don’t need American permission to adopt or use the dollar for payment of goods and services. Aruba uses the dollar for local businesses as does Curacao, St. Martin, Anguilla, Tahiti, and virtually all the overseas territories of European mother countries. Every country uses the dollar unofficially including Russia, China, the Philippines, Indonesia, and Bolivia, among others. There is strong demand for dollars everywhere. More than two-thirds of US currency is in circulation outside of the US.

Adopting the Greenback is not a solution to a country’s economic problems. President Clinton’s Treasury Secretary Lawrence Summers pointed out that a monetary union with the US was/is not a substitute for sound policies to strengthen an economy and its financial system. A country must have a stable currency which requires economic stability. Alan Greenspan advised that stability mandates a well-regulated, well-capitalized financial system, budget balance, and low foreign borrowing, and other conditions. Economic stability also requires a lid on corruption which Lee Kwan Yew recognized in Singapore adopting zero tolerance for the corrupt. Guyana is far off from meeting conditions to adopt the US dollar as its currency. We have been plagued with financial turmoil post-independence. The Guyana dollar has slid from around G$1.75 to the US dollar at independence in 1966 to around $206 today.

But even if Guyana does not adopt the US dollar, the Guyana dollar needs to be revalued perhaps pegged at one-to-one with the Greenback to make payments easier. It is very difficult to move around with the bulk of Guyana dollars to pay for goods and services. A bulky pocket or envelope or bag makes an easy target for choking and robbing. And too many have been robbed for decades. A fixed value against the dollar as Barbados has done at two to one since independence in 1966 will help to put a lid on inflation and address wide fluctuation in prices. With ongoing huge capital inflows, prices will fluctuate but a fixed currency will make it easier for consumers. A fixed exchange rate will freeze the value of the Guyana currency irrespective of trade imbalance (Guyana currently runs a trade surplus because of oil revenues).

Much of our economic activities are already done in US dollars. Also, payments to companies that provide services in Guyana are paid in US dollars. Policymakers should take a look at adopting or using the American dollar as the medium for conducting local business.